US regulators are finally discussing the issue of fiat-backed digital assets, popularly known as stablecoins.

According to the Federal Reserve’s vice chairman for oversight, Michael Barr, it is imperative that stablecoins also come under the government’s supervisory oversight.

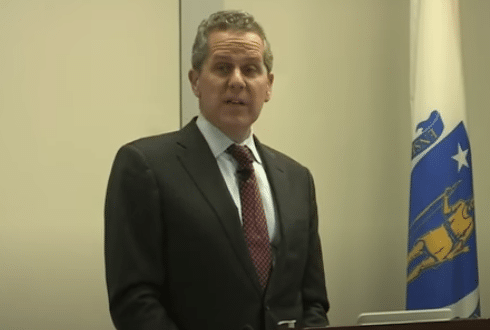

Presenting his idea at a conference held in Washington DC, Barr unequivocally stated that the ability of a stablecoin to be pegged to any government-issued currency makes it private money.

Additionally, these digitized fiat currencies serve as means of payment and storage of value, meaning they are borrowing the trust of the central bank.

Barr, who was appointed by President Biden as the Federal Reserve’s top banking cop, has argued that stablecoins should be regulated in light of these strong indicators.

Expanding on his position, he noted that it is essential that stablecoins are subject to an appropriate prudential financial framework to prevent them from posing risks to financial stability or the integrity of payment systems.

“We have also provided appropriate guidance to the banks we supervise on how they should engage with their supervisors when considering the use of these products,” Barr added.

Barr’s comments relate to the growing belief among US regulators about the need for a strong handle on the crypto space.

In recent years, calls for proper oversight of the fast-growing decentralized economy have echoed through the walls of Washington DC. However, stablecoins have been the least considered.

So far this year, the Fed, which serves as America’s equivalent of a central bank, has taken a more cursory look at the potential impact a privately controlled digitized sovereign currency could have on the economy

To that end, the Federal Reserve launched a new set of guardrails specifically targeting crypto-assets and stablecoins in August of this year.

In their rulebook, the feds announced the launch of a new program codenamed SR 23-7, which stands for its New activities monitoring program.

In this new environment, the Fed said it is looking to improve oversight of new technologies used by banking institutions under its purview.

These new technologies directed crypto assets, blockchain technology and complex technology-driven partnerships with non-bank entities to provide financial services to customers.

Regarding the objectives of the SR 23-7 program, the central bank specified that it would be risk-focused and complementary to existing supervisory guidelines designed to regulate banking activities.

In a related press releasethe Federal Reserve stated that banks would not be prevented from engaging in stablecoin activities.

However, they would have to demonstrate to the nation’s lender of last resort that adequate security guards are in place before they begin.

A CBDC decision not yet made

Barr, who serves as vice president of oversight, also discussed the long-running quest for a central bank digital currency (CBDC) in his address.

He stated that the central bank is currently consulting with a wide range of experts on the most robust and appropriate emerging technology that would support a sovereign-backed digital currency.

This research focuses on system architecture, security, verification and end-to-end tokenization models for CBDC. However, he claimed that no unanimous decision had been made on whether to issue a CBDC.

The Fed official, however, said the decision ultimately rests with the US Congress and the White House.

While the United States has been reluctant to launch a CBDC program, its European counterpart is pushing ahead with plans for a digital euro.

The euro is key to our European unity. A digital euro, existing alongside cash, would be our future-proof currency. It would be safe, easy to use and free.

Although the decision to issue a digital euro will be taken later, we are now starting the preparation phase. pic.twitter.com/fs81p7otVW

— Christine Lagarde (@Lagarde) October 19, 2023

According to an October 19 tweet on X (formerly Twitter) by the director of the European Central Bank (ECB), Christine Lagarde, the ECB’s governing council has given the green light to start the preparation phase.